Understanding the New PDF Form W-9 (Rev. March 2024): A Guide for Tax Compliance

Table of Contents

- Free IRS Form W9 (2024) - PDF – eForms

- W-9 Form 2024-2025 - How to Fill Out and Download - PDF Guru

- W9 Form Download 2025 - Hollie Roseline

- W9 form 2021: Fill out & sign online | DocHub

- W9 Form Download 2025 - Hollie Roseline

- Print W 9 Form Printable Irs - Printable W9 Form 2024 (Updated Version)

- W-9 Form 2024 Printable Pdf Irs.Gov - Randy Carrissa

- W 9 Free Printable Form - Printable Forms Free Online

- Irs W9 Printable Form 2023 - Printable Forms Free Online

- W9 2025 Form - Max Bower

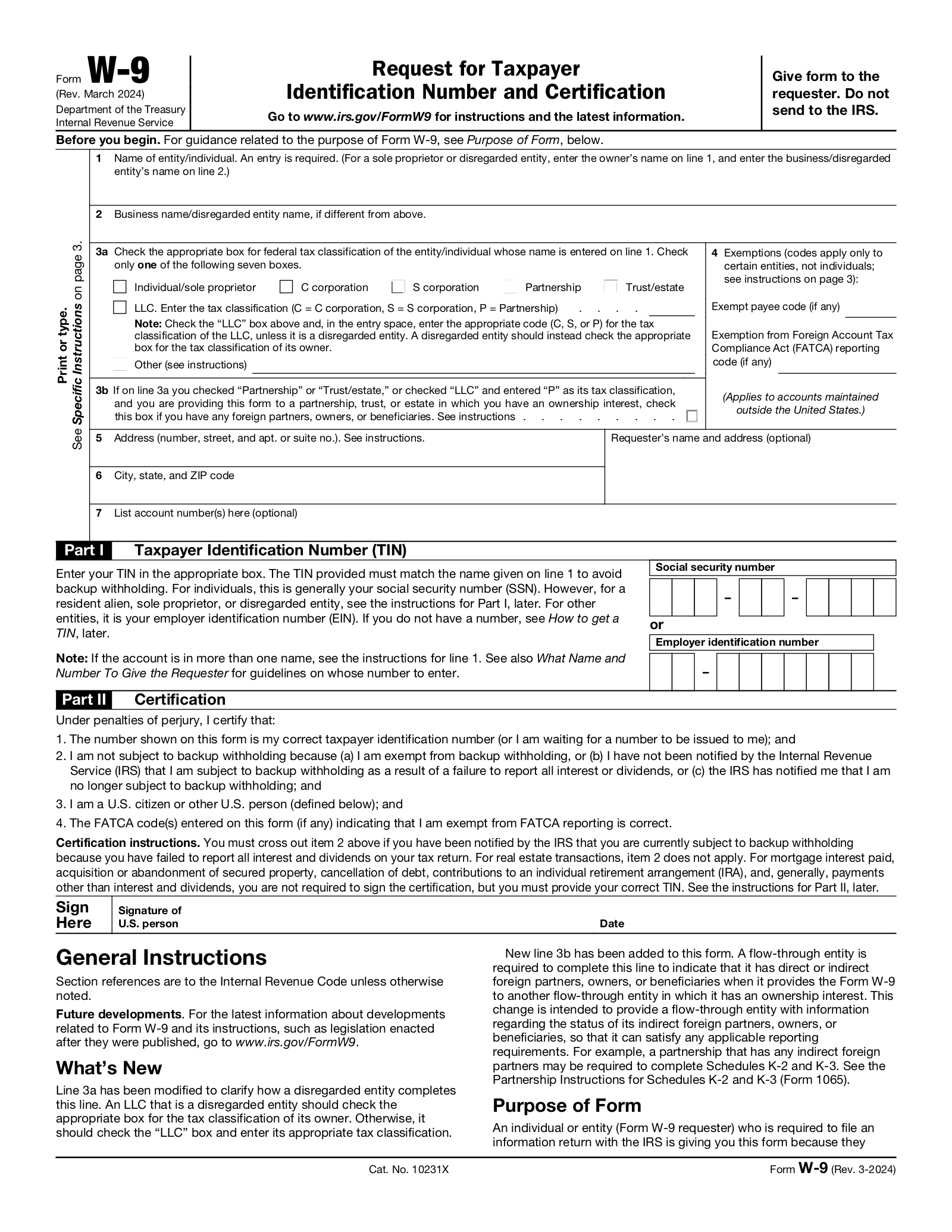

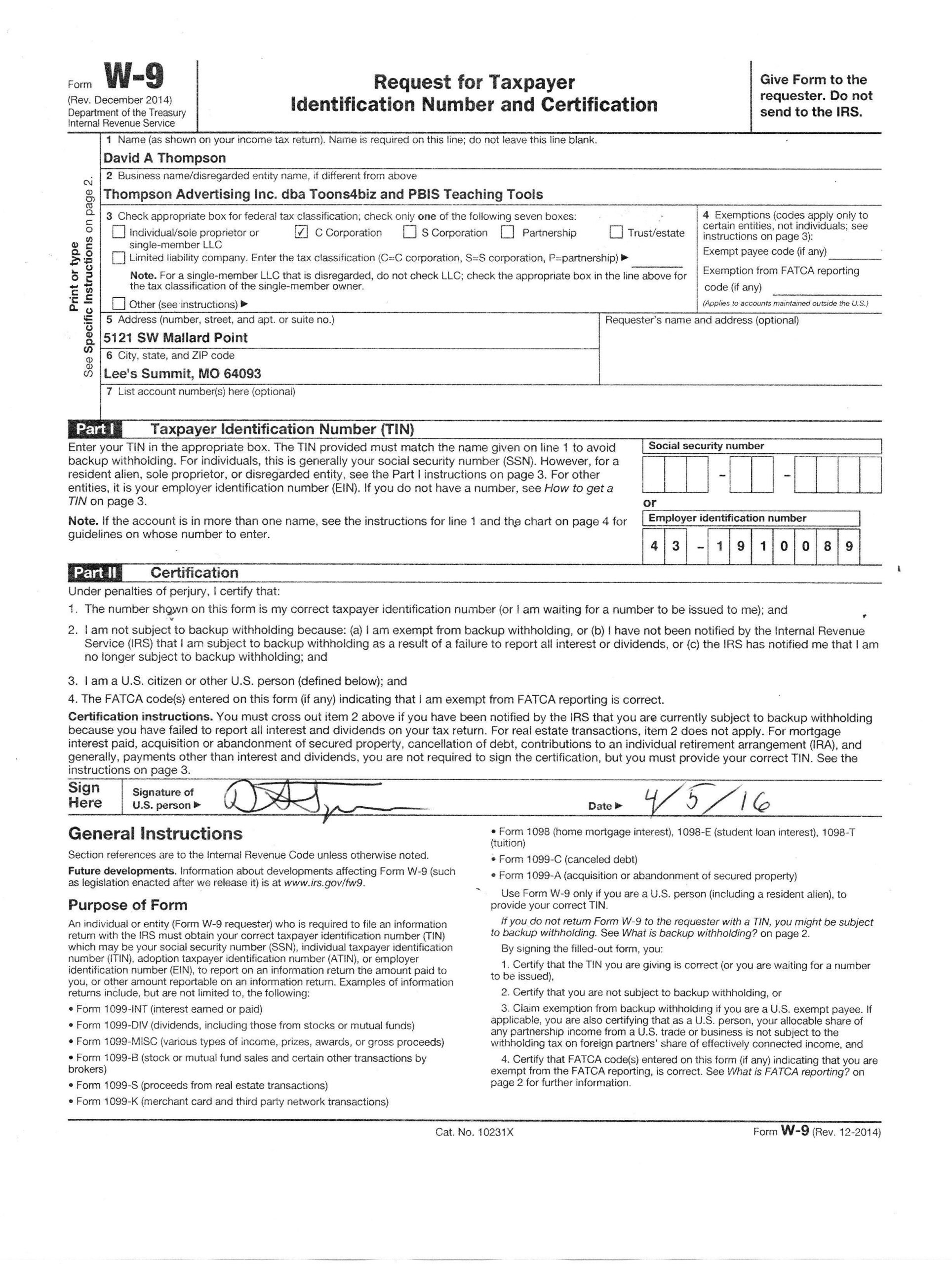

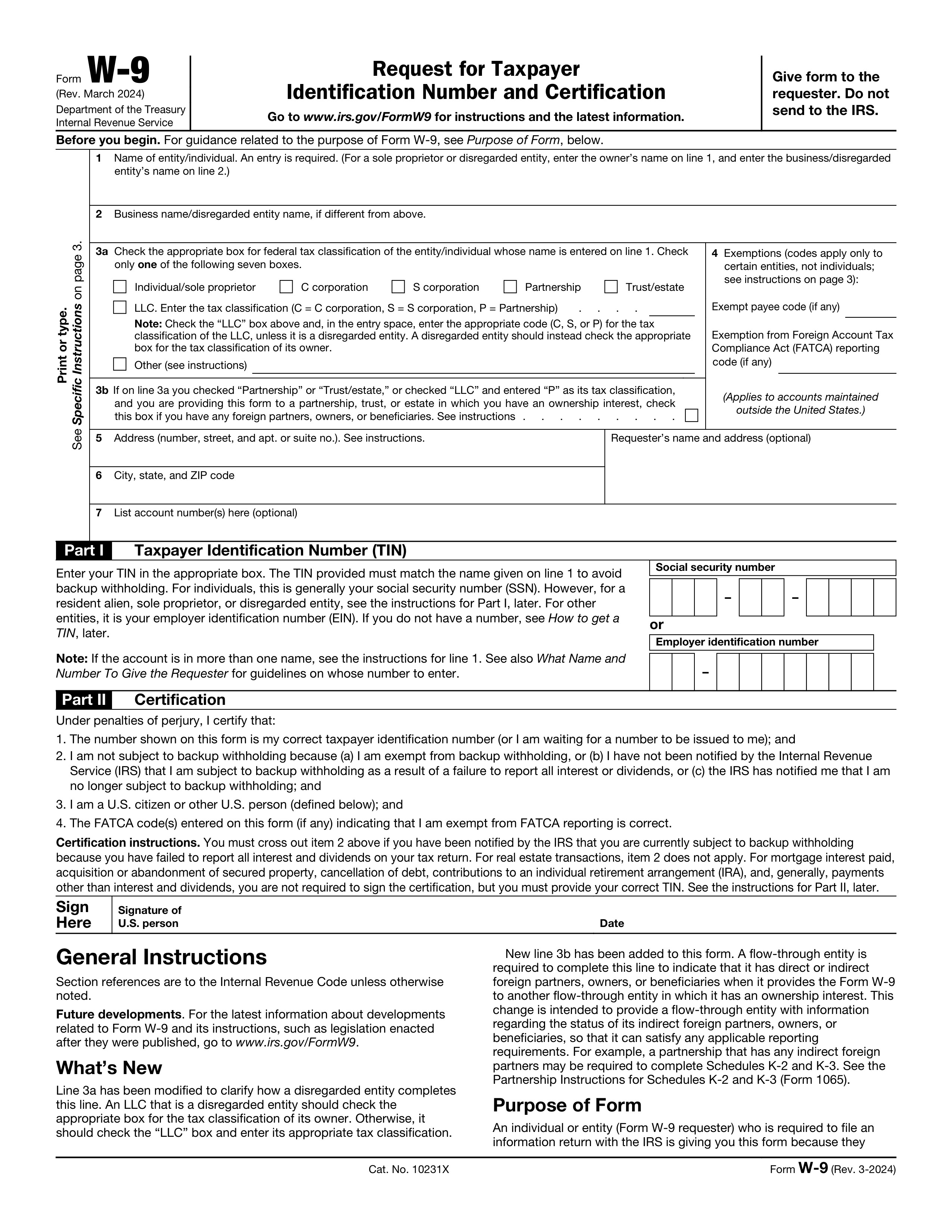

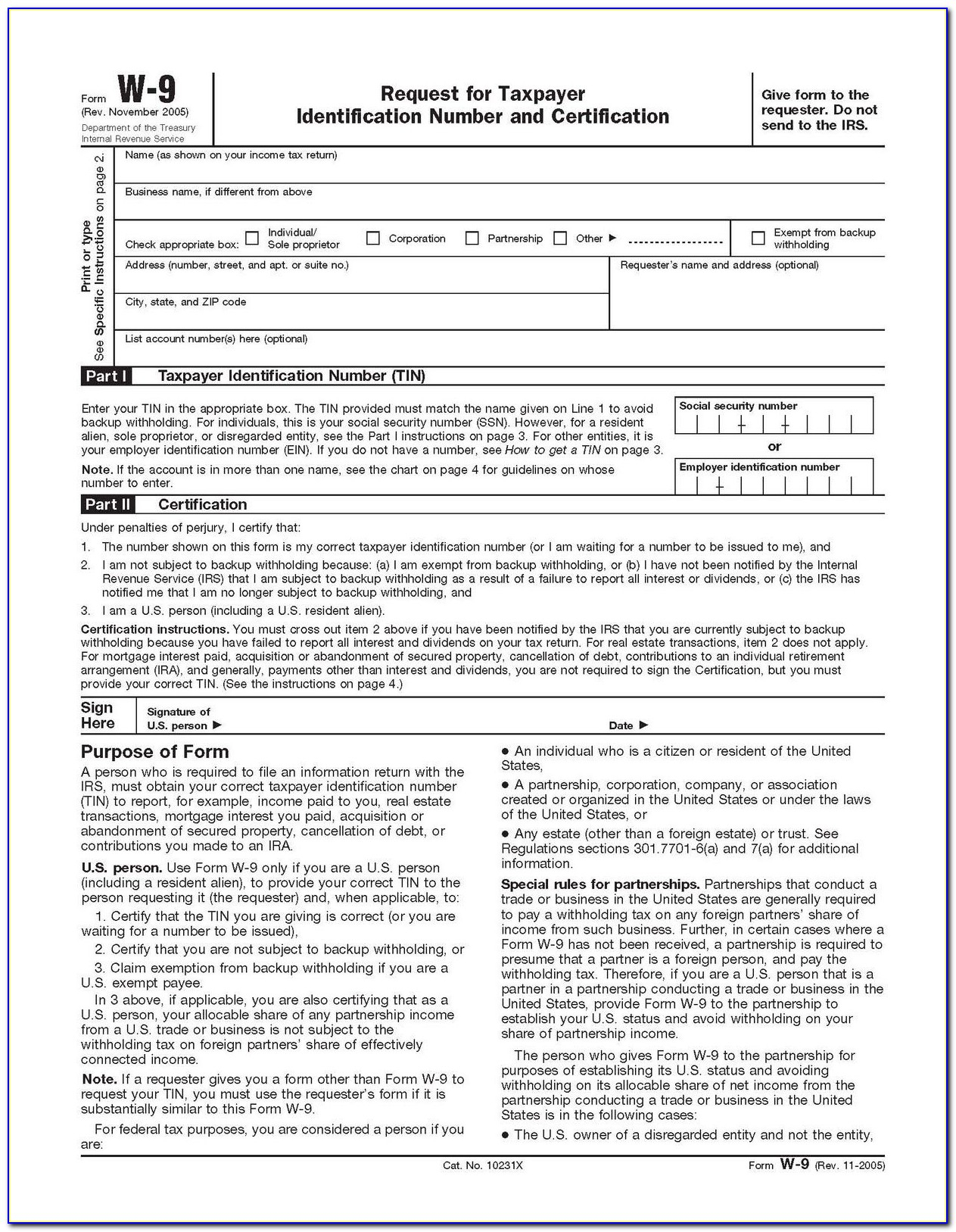

The PDF Form W-9, also known as the Request for Taxpayer Identification Number and Certification, is a standard form used by businesses and other entities to provide their taxpayer identification number (TIN) to other parties, such as banks, financial institutions, and government agencies. The form is typically required for entities that are subject to backup withholding, such as independent contractors, freelancers, and sole proprietors.

Key Changes in the Updated PDF Form W-9 (Rev. March 2024)

Importance of Accurate Completion

To ensure accurate completion, entities should carefully review the form's instructions and provide all required information, including their TIN, business name, and address. It is also essential to certify their tax status and provide any additional required documentation.

In conclusion, the updated PDF Form W-9 (Rev. March 2024) is a critical document for tax compliance in the United States. Entities must ensure accurate completion of the form to avoid potential penalties and backup withholding. By understanding the key components and changes in the updated form, businesses and individuals can ensure compliance with current tax laws and regulations. For more information and to access the new PDF Form W-9 (Rev. March 2024), visit taxdepartment.gwu.edu. By following the guidelines outlined in this article and using the updated PDF Form W-9 (Rev. March 2024), entities can ensure seamless tax compliance and avoid any potential issues.